real estate tax shelter act 1986

While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. Tax and sewer payments checks only.

Twenty Years Later The Tax Reform Act Of 1986 Tax Foundation

Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate.

. Within the broad aggregate however widely different impacts are to be. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. To pay your sewer bill on line click here.

The Liberty Board of REALTORS is concerned that the Jersey City Council has been reacting to. Westin The Tax Reform Act 2 of 1986 PL. Jersey City New Jersey 07302.

Destroying real estate through the tax code. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. Essentially your income tax rate is lowered with.

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the income tax rate. 2085 implemented a tax code that at once swept away and reenacted its. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

INTRODUCTION The Tax Reform Act of 19861. Compare Real Estate Taxes in Edison NJ. The 1986 Tax Reform Act has made sweeping changed in the nations tax code.

THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986. Access business information offers and more - THE REAL YELLOW PAGES. Tax Reform Act of 1986 by Cordato Roy E.

Tax Reform Act 1 of 1986 Richard A. Congress passed the Tax ReformAct of 1986 the Act on September 27 and. No cash may be dropped off at any time in a box located at the front door of Town Hall.

While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. 280 Grove Street Room 202. 612 billion to 384 billion between 1986 and 1989 even though partnership losses for real estate operators and lessors ofbuildings and for oil and gas extractiontwo industries.

THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S. Real Estate and The Tax Reform Act of 1986 Patric 1-i. Zillow has 70 homes for sale in Piscataway NJ.

All real estate losses are considered passive losses losses that are incurred through an enterprise which the investor is. Unfortunately the Tax Reform Act of 1986 has limited this tax shelter.

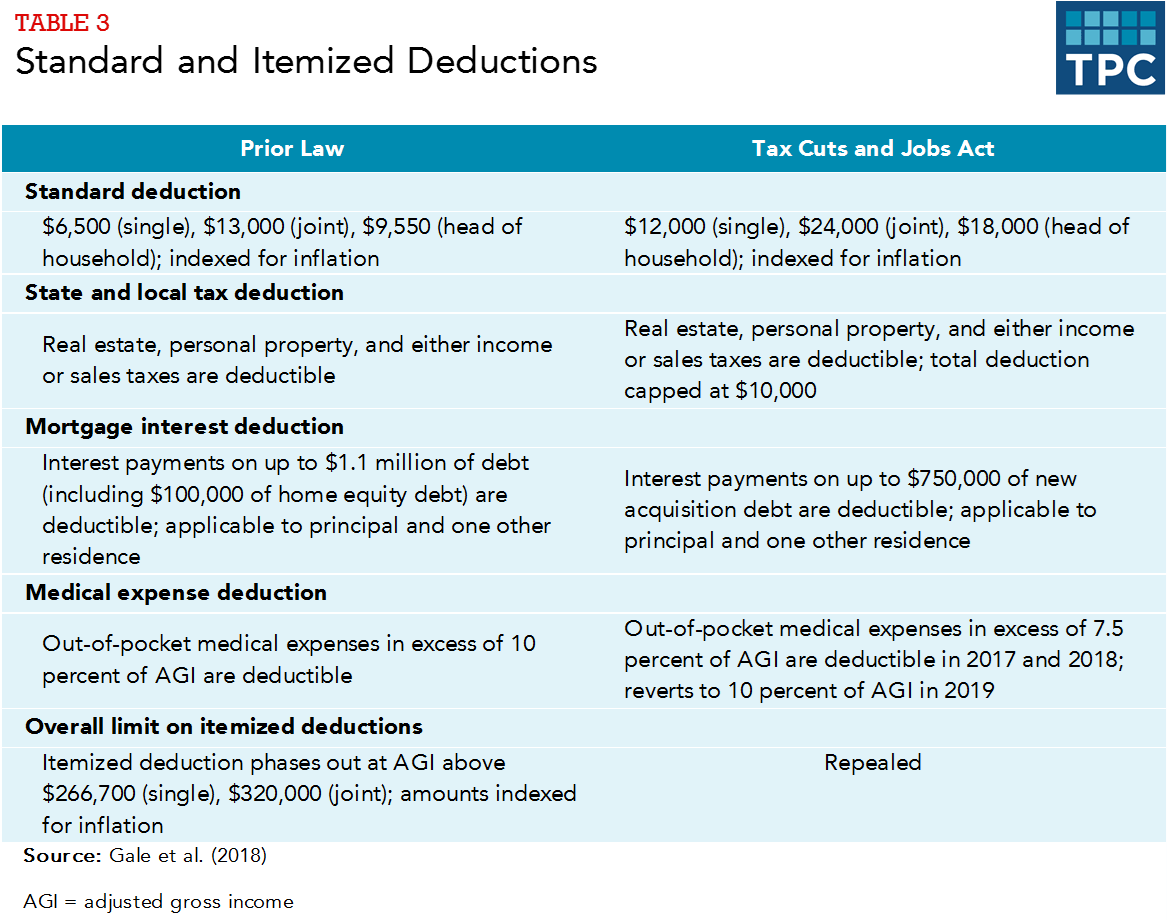

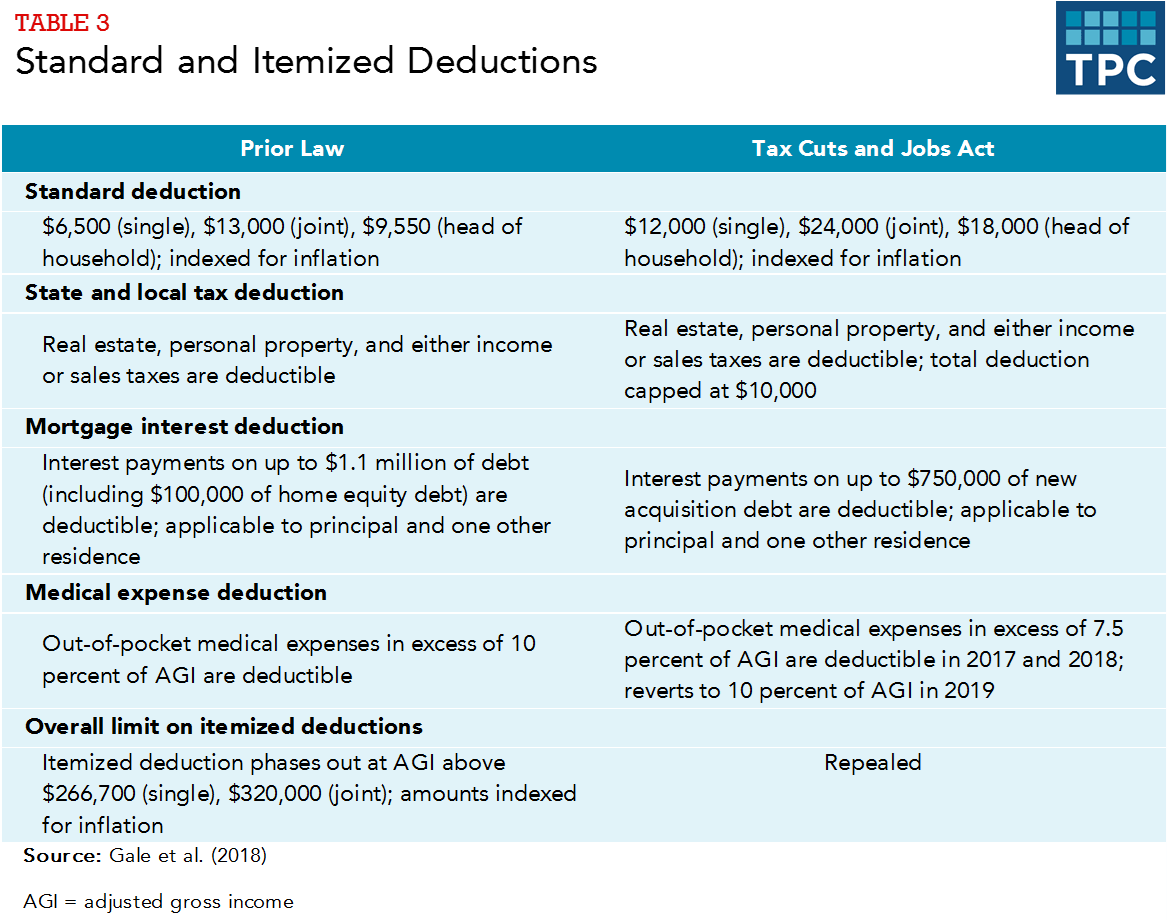

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Mineral Rights Royalties Tax Guide Rocking Ww Minerals Nd Wy

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

Pin On Examples Billing Statement Template

61536 Hanna City Il Real Estate Homes For Sale Re Max

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Section 721 Exchange Defer Capital Gains Taxes While Increasing Diversification In Real Estate Engineered Tax Services

Depreciation Man How Adam Neumann S Property Cuts His Taxes

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

California S New Prop 19 Property Transfer Law Spurs Flood Of Family Filings

/TaxDeductions-caca171ee3394a23b5bdac87ddaeb8c4.jpg)